Shopify Inc. (NYSE: SHOP) has become a dominant player in the e-commerce industry, offering a platform for small and medium-sized businesses to create and manage their online stores. The company has experienced significant growth over the past few years, and its stock has been on an upward trajectory, reaching all-time highs in 2021. In this article, we will take a closer look at Shopify’s growth story, the factors driving its success, and the future prospects of its stock.

Overview of Shopify’s Growth Story

Shopify was founded in 2004 by Tobias Lütke, Daniel Weinand, and Scott Lake, as an online store to sell snowboarding equipment. The founders quickly realized the potential of their e-commerce platform and pivoted to focus on developing a software-as-a-service (SaaS) platform to help other businesses build and manage their online stores.

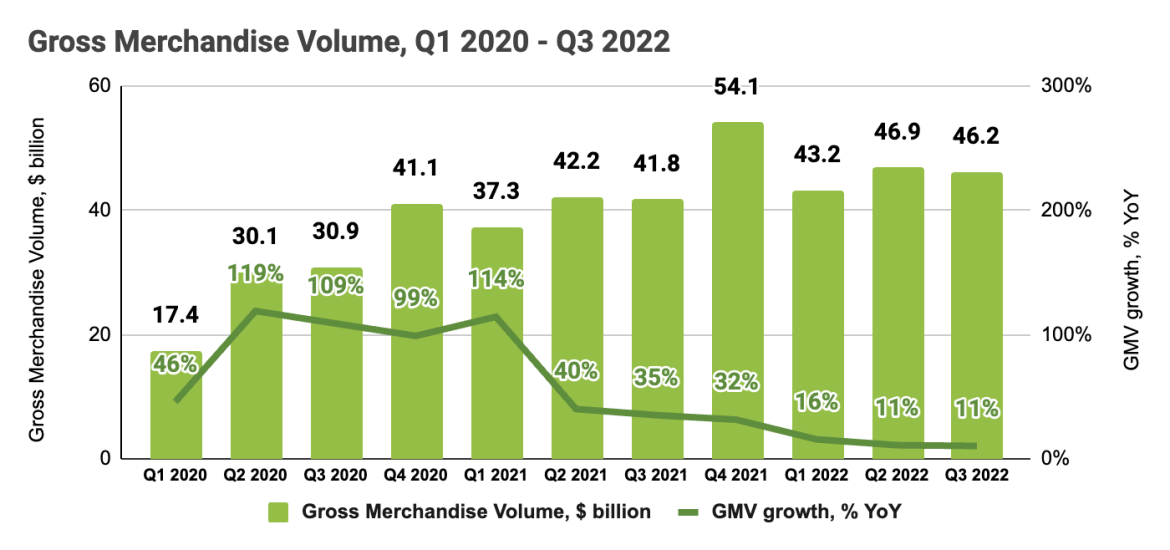

The company’s revenue growth has been impressive, with total revenue increasing from $205.2 million in 2015 to $2.9 billion in 2020, representing a compound annual growth rate (CAGR) of 68%. In the first quarter of 2021, the company’s revenue reached $988.6 million, up 110% year-over-year.

Shopify’s growth has been driven by several factors, including:

- The Shift to E-commerce: The COVID-19 pandemic has accelerated the shift to e-commerce, with more consumers shopping online due to lockdowns and social distancing measures. Shopify’s platform has allowed businesses to quickly pivot to an online presence, leading to an influx of new merchants.

- Platform Innovation: Shopify has continued to innovate and develop new features for its platform, such as Shopify Payments, which allows merchants to accept payments directly on their website, and Shopify Capital, which provides funding for businesses to grow their operations.

- International Expansion: Shopify has expanded its reach globally, with merchants in over 175 countries. The company has also opened offices in multiple countries to support its global operations.

Factors Driving Shopify’s Success

- High-Quality Platform: Shopify’s platform is easy to use, flexible, and customizable, making it a popular choice for small and medium-sized businesses. The platform is also highly scalable, allowing businesses to grow their operations without worrying about infrastructure limitations.

- Diversified Revenue Streams: Shopify’s revenue is diversified across several sources, including subscription fees, merchant solutions, and Shopify Capital. This diversification helps mitigate risk and provides a stable revenue base for the company.

- Strong Brand: Shopify has built a strong brand in the e-commerce industry, which has helped attract new merchants to its platform. The company has also created a strong community of users, with a vibrant ecosystem of developers, designers, and other partners.

Future Prospects for Shopify’s Stock

Shopify’s growth prospects remain strong, with several factors driving its future success:

- Continued Growth in E-commerce: E-commerce is expected to continue growing in the coming years, with more consumers shopping online. This trend is expected to benefit Shopify, as more businesses look to establish an online presence.

Expansion into New Markets:

Shopify has opportunities to expand into new markets, such as social commerce and online marketplaces. The company has already launched a shopping app, Shop, which allows users to browse and buy products from their favorite stores, and has also partnered with social media platforms to make it easier for merchants to sell on these channels.

Innovation and Development:

Shopify will continue to innovate and develop new features for its platform, making it even more valuable for merchants. The company is also exploring new technologies, such as augmented reality and virtual reality, to enhance the e-commerce experience