Introduction:

Investing in the stock market requires a lot of research and analysis, and keeping up with the ever-changing market can be a daunting task. However, investors have access to a useful tool to stay informed and up-to-date with corporate earnings reports and other significant market events – an earnings calendar.

An earnings calendar is a schedule of dates when publicly traded companies release their financial reports. It provides investors with critical information about a company’s financial performance, allowing them to anticipate the market’s response and make informed investment decisions.

In this article, we will provide a comprehensive guide on what an earnings calendar is, how it works, and why it is essential for investors. We will also discuss the benefits of using an earnings calendar and provide practical tips on how to use it to maximize your investment returns.

What is an Earnings Calendar?

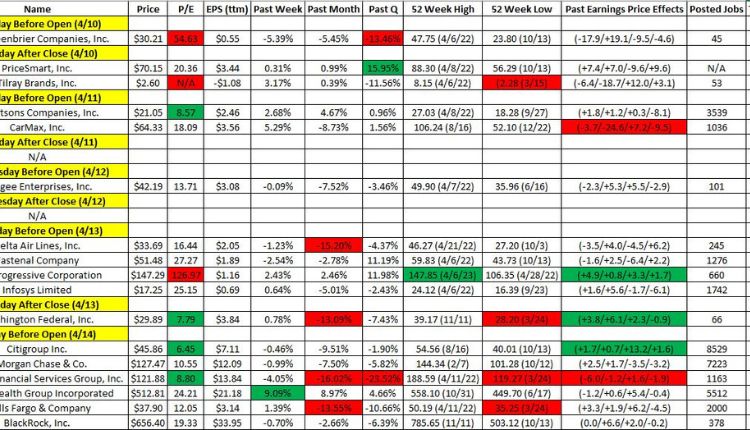

An earnings calendar is a schedule of dates when publicly traded companies release their financial reports. These reports contain critical information about a company’s financial performance, including revenue, earnings per share, and net income. The earnings calendar also includes information about other corporate events, such as stock splits, dividend payments, and annual shareholder meetings.

The earnings calendar is a helpful tool for investors to track upcoming events that may have a significant impact on a company’s stock price. Investors can use this information to plan their trades, predict market trends, and make informed investment decisions.

How Does an Earnings Calendar Work?

An earnings calendar works by providing investors with a schedule of dates when publicly traded companies will be releasing their financial reports. These reports typically include information about a company’s revenue, earnings per share, and net income for a particular quarter or year.

Investors can use the information provided in the earnings reports to analyze a company’s financial performance and anticipate the market’s response. This information allows investors to make informed investment decisions and adjust their trading strategies accordingly.

Benefits of Using an Earnings Calendar

Using an earnings calendar provides investors with several benefits, including:

1. Anticipating Market Response: The earnings calendar provides investors with critical information about a company’s financial performance and the market’s response to that performance. By anticipating market trends, investors can plan their trades and make informed investment decisions.

2. Timely Trading: The earnings calendar enables investors to time their trades effectively. By knowing when a company will release its financial report, investors can avoid unexpected surprises and make trades when the market is most active.

3. Identifying Investment Opportunities: By analyzing a company’s financial performance, investors can identify investment opportunities in the stock market. Earnings reports provide valuable information about a company’s strengths and weaknesses, enabling investors to make informed decisions.

Tips for Using an Earnings Calendar

To use an earnings calendar effectively, investors should consider the following tips:

1. Check the Date and Time: The earnings calendar lists the date and time of each company’s earnings release. Investors must check the time zone to avoid missing critical announcements.

2. Analyze Expected Earnings: The earnings calendar includes analysts’ estimates of the company’s earnings per share (EPS) and revenue for the quarter or year. Investors should compare the current earnings with the previous earnings reports to identify any improvement or decline in the company’s performance.

3. Monitor the Surprise Factor: The earnings calendar includes the “surprise factor,” which measures how much the reported earnings differ from the analysts’ estimates. A higher surprise factor indicates that the company’s performance exceeded expectations, which may result in a significant market reaction.

Conclusion:

An earnings calendar is a valuable tool for investors to stay informed and up-to-date with corporate earnings reports and other significant market events. It provides critical information about a company’s financial performance, allowing investors to anticipate the market’s response and make informed investment decisions

previous post